We’ve gotten hundreds of questions about the financial side of running an Airbnb or other short term vacation rental. Specifically: “can you detail the expenses and fees that take a bite out of the profit? Are there hidden costs? How exactly do rental taxes work? Insurance?! ACK!“

Whether the person asking us was considering doing one themselves, or just plain curious (talking about money = interested face emoji), we’re laying it all out in the hope that it demystifies it a little bit, and is helpful to anyone who might be on the fence about whether or not this is a viable side hustle. We actually really enjoyed learning the ins & outs of this stuff – so it’s fun to share what we learned.

Obviously there are expenses like actually purchasing, renovating, and furnishing a home that you’ll be using as a vacation rental. Those big obvious start-up costs will differ by project (as will your mortgage payment) – and heck you might be Airbnb-ing your own house, which is already full of furniture – so this post picks up from the “ok, I have a rental-ready house, now what?” point, and covers the on-going “operating” costs that you may incur year over year.

We’re sharing REAL NUMBERS from our experience with you. Just please don’t take them as predictive of your own costs, which obviously will vary. It also bears reminding people that the duplex is one building, but it’s TWO distinct rental units (totaling 6 bedrooms, 6 bathrooms, 2 kitchens, 2 living rooms, 2 laundry rooms, 2 backyards, etc). So if you’ve got just one rental and/or a smaller space, these numbers might be much higher than any that you’ll incur.

Utilities

The existence of utilities is probably not a surprise to anyone, but how much they really cost can catch you off guard if you don’t do the math and look at the year as a whole. Unlike a typical long-term rental where your tenant may be responsible for some or all of the utilities every month, in the vacation rental world, you typically pay for all of them. At the duplex, we pay for the following utilities:

- Water & Sewer

- Electricity

- Trash Pick-Up

- Internet

- TV / Streaming Services (we provide Sling and Netflix)

For other people the list might also include gas, oil, or propane (depending on your heat source) and even parking or HOA fees.

Our utilities combined for both sides of the duplex cost about $5,200 a year, based on the last 12 months. The most important thing to think about is that utilities don’t disappear when the house isn’t rented (which can be very important if you’re renting somewhere seasonal). Our electrical and water bills go down a little bit when there’s lower usage in the offseason, but there are minimum fees that keep them at around $150 a month.

We looked into pausing some of our duplex utilities (like internet or trash pick-up) in the vacant winter months but many come with a hefty reconnection fee that negate any potential savings. We are able to pause some of our streaming TV subscriptions (Netflix & Sling) when we knew the place would be empty for a solid month in the offseason, which was nice. (Just don’t forget to restart them in time for the next guest!).

Lawn Care / Property Management

If you’ve ever rented a vacation home, you’re probably used to seeing a “Cleaning Fee” on your bill. That’s typically the cost of someone to clean the house after your stay so that it’s ready for the next guests (this includes doing laundry, remaking beds, unloading dishes, etc, etc). We charge a cleaning fee of $150 per stay because that’s precisely what our cleaner charges us. So this cost is a total wash on our end. Zero dollars spent a year, except for a holiday tip ;)

But outside of the cleaning fee, you may have other regular maintenance costs to keep it ready for each guest. This might be things like lawn care, pool or hot tub service, or even snow-blowing if you host in a wintery destination. We pay a small local landscaping company to mow the yards and blow the outside areas of the duplex on a consistent, reliable schedule. This isn’t a year-round cost luckily (nothing happens in the winter months) but since they come more frequently during the spring and summer when everything is growing like crazy, it adds up to about $800/year.

I remember at our last Florida rental there was a pool guy AND a separate lawn crew that came by while we were staying there. Neither were costs he passed along directly to us when we booked, so they came out of his rental profit.

Another potential expense would be if you choose to hire or rely on a professional property management or rental management service. They can take a lot off your shoulders (handling bookings, cleanings, and issues that arise) but they typically charge a percentage of every booking. In Cape Charles, the rate seems to be about 20%, but that number may vary depending on your area and exactly what services they offer.

Restocking Consumables

Because we choose to provide consumable items for our guests, we not only bought the initial stash, we also have to replenish everything when it’s running low. Here’s a list of what we provide:

- Toilet paper (we provide 6 rolls per side of the duplex)

- Paper towels (1 roll in each kitchen)

- Napkins (stack of them in a bowl in each dining room)

- Tissues (1 box per bathroom – we don’t replace these each week, just as needed)

- Sponges (1 new sponge in each kitchen)

- Trash bags (2 in each kitchen & all bathrooms)

- Tinfoil and Ziplock storage bags in various sizes

- Shampoo, conditioner, hand soap, & body wash

- Laundry detergent, fabric softener, & stain remover

- Salt & pepper and olive oil for cooking

- Coffee grounds, tea bags, and sugar packets

Every time we share what we provide our guests we hear from people who say “we do all of those too!” and others who say “what?! nobody provides that stuff here!” My best guess is that it varies by region, but many other vacation rentals in Cape Charles also provide similar items. At the end of the day, if it helps our guests feel at home, we’re happy to have it on hand.

All told, we spent $900 on those items above this year. Again, it might not be a big line item in your region at all – but it’s smart to figure out what you’re planning to have available, and how much you think it’ll be to replenish things throughout the year.

Extra Linens & Towels

This may be something specific to how our cleaner operates, but she advised us at the start of the summer to keep a COMPLETE extra set of bed linens and towels handy, that way if laundry ever didn’t finish in time or there was a stain that needed longer treatment, she could still leave our next guests with everything they needed. So for us this meant buying:

- 8 extra bath towels

- 6 extra beach towels

- 12 extra washcloths & hand towels

- 1 extra set of queen sheets & 1 queen duvet cover & insert (we rolled the dice that it was unlikely both queen beds would be stained)

- 2 extra sets of twin sheets & 2 twin quilts

Actually you should double those numbers because we did that PER SIDE. Thank goodness for the locked owner’s closet, where we stashed that extra stuff in bins.

We never ended up relying on a complete extra set, but we did dip in and grab one or two spares more than once, so we’re definitely glad we had them around (the two extra duvet covers especially!). This extra stock of linens and towels cost us over $400 per side (for a total of $800). We’ve also had to replace a couple of towels over the last few months (we feel very lucky that’s all we’ve had to replace!) so either grabbing extras ahead of time or setting aside a small budget for the replacement of random items as you go is probably a smart idea.

Insurance & Taxes

Now we’re getting to the fun stuff (ha!). Let’s start with insurance first.

It hopefully doesn’t surprise you that your property should have insurance on it, but we found insuring the duplex to be a bit of a learning curve. But we came out on the other side! The complicating insurance factors of our duplex are: 1) the fact that it is a short term vacation rental, which is treated differently than a full-time residence and 2) it’s near the water (mo water, mo problems – at least that’s what the insurance folks say). Those two factors meant we had limited options, but we ultimately ended up with three policies that work together to give us peace of mind.

- A vacation rental property insurance policy: This is similar to the homeowner’s policy you might have on your primary residence. Just make sure whatever you get covers short term rentals.

- An add-on liability policy: This was recommended by a few friends who also have vacation rentals, and provides additional coverage for any possible accidents, injuries, etc.

- A flood policy: We’re not technically in a flood plain, but most residents consider it wise in Cape Charles.

We don’t need either of those last two policies for our primary residence here in Richmond, but if you’re renting out your primary or secondary residence part-time, you might want to consult with an expert to make sure you’re sufficiently covered with your existing policy. Many standard homeowner’s policies may not suffice if the damage or incident occurs while a short term renter is occupying your house.

If you thought insurance was fun, boy will you love taxes! Taxes are the part that we felt like we knew the least about going into this, but it’s pretty straightforward to figure out. So take this as your cue to investigate what’s going to be due in whatever town or city you’re operating your rental in (call your local government office, check out their website, or ask other hosts in your area). But also please know that if it feels complicated, everyone we spoke to at our various government offices was super happy to help (they were probably thrilled we were trying to pay our taxes – ha!) and within a week or two we got the hang of it.

For the duplex we pay the following:

- Annual county property tax

- Annual town property tax

- Quarterly county transient occupancy tax (a tax on vacation rental income specifically)

- Monthly town transient occupancy tax

- Monthly state & local sales tax

The property taxes collected by the two localities where the duplex is located (the first two items listed above) are based on the house itself, not on how much or how little we rent it out. But the others are percentages of what we earn from our rental income and we have to calculate and submit paperwork for them on a monthly or quarterly basis (although now Airbnb does the sales tax automatically in Virginia when guests check out on their site – but all summer we had to take it out of our Airbnb payouts manually).

You may get lucky and your town won’t charge transient occupancy tax, but you might end up getting charged twice like we do: once by the town, and then again by the county. I feel like I keep saying “vary wildly” in this post, but taxes really do that as well. For example, my dad has a rental in another state and he pays a 3% transient occupancy tax, while ours is 6% in Cape Charles. Between those two transient occupancy taxes & the sales tax, about 11% of every booking we had this summer went to the state, county, & town in the form of taxes. Keep in mind that does not include property taxes.

So for the duplex, our combined taxes and insurance for this year have been about $13,400. Long story long – you should definitely know you tax responsibilities when you’re weighing the viability of your rental because they can definitely affect your profit.

Airbnb Host Fee

If you run your rental through a site like Airbnb, VRBO, or HomeAway, keep in mind that they also take a cut of your nightly rental rate. As a guest you’re probably used to paying a fee that’s tacked on top of the total nightly rate, but behind the scenes Airbnb also deducts a 3% fee from the nightly rate before they pay the host. So I guess neither the guest or the host are actually getting the listed nightly rate. Ha! We don’t really include that 3% fee in our operating cost calculations (or our total at the end of this post) because it’s money we never see. So just remember that when you set your nightly rate, a bit of that will go to whatever rental website you choose.

We get asked why we chose Airbnb over other vacation rentals like VRBO or HomeAway, and the answer is just that we polled a few friends with vacation rentals & they all liked that interface the most. So we went for it. So far we really like it. We contemplated listing the duplex on multiple sites but heard it can be hard to avoid double booking dates when you’re running multiple calendars across different platforms.

Miscellaneous Costs

And while we tried to be super thorough in this post, we can’t predict everything that you might encounter along the way. This year, we probably spent around $750 in miscellaneous items. Thankfully nothing crazy happened (we didn’t have to replace an HVAC system or anything like that) but one tiny example is that we learned that the state and town also collect a small fee for an annual business license (and perform an annual rental inspection to make sure we’re still up to code each year) so that was a small unplanned expense that surprised us – but now that we’re used to it and know what to do, it’s easy peasy.

There are of course costs like replacing things that break, paying a maintenance guy to fix a malfunctioning appliance, or even adding/changing a particular amenity in your home. A concrete example of that is that we spent $250 halfway through the summer to add blackout curtains to the two front bedrooms at the duplex after a few guests mentioned it got very bright in there early in the morning. So while it might be a ding to your budget, it’s all part of the fun & adventure of trying to provide an awesome experience for the people who are staying at your house. Speaking of which…

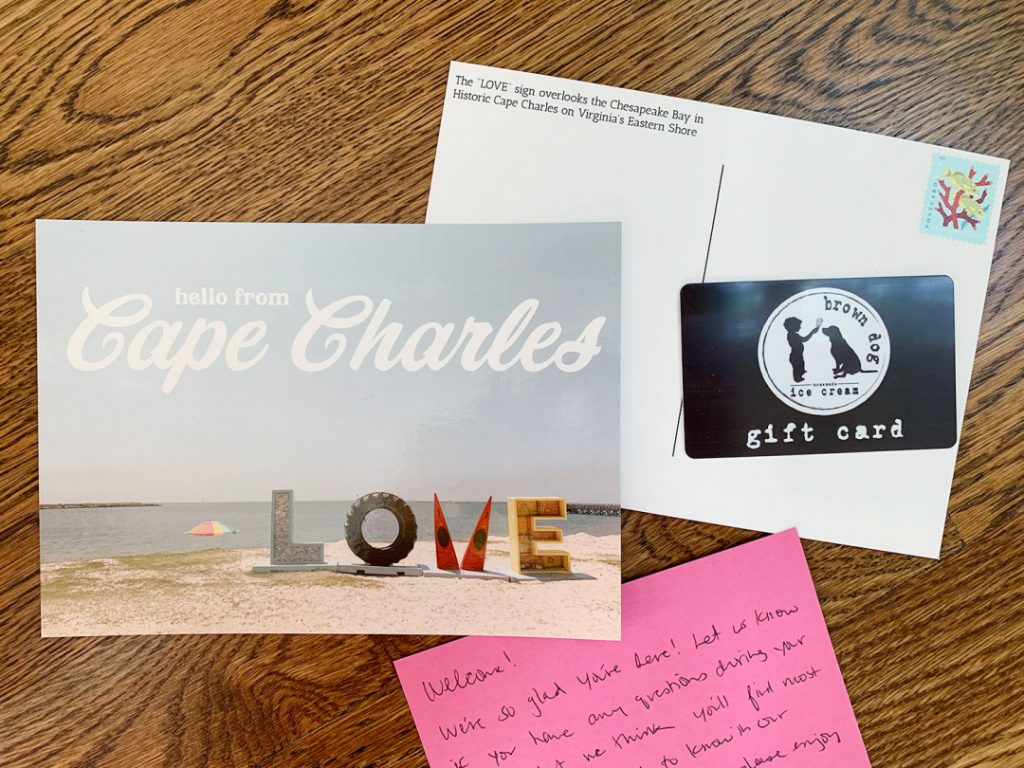

We also choose to leave our renters a little welcome gift when they arrive. It’s a handwritten note with a gift card to get ice cream or a souvenir at one of the local shops in town, along with a pre-stamped postcard. Again, that’s definitely not a cost you have to incur, but we’re happy to do it in the hopes that our guests enjoy their stay and frequent some of the great local businesses – and our guests seem to really like it too. Who doesn’t like ice cream?!

Let’s wrap this puppy up. I’ll spare you some scrolling and recap all of the math above. Combining all of the costs that we just laid out, it’s about $21,750 in annual “operating” expenses for the duplex this year. Again, that’s for two separate rental units, so it’s likely higher than a single or smaller rental. But our point is less about the total number and more about the variety of costs along the way. So if you’re considering starting an Airbnb, I hope this post is a jumping off point for figuring out your own operating costs in the categories I listed here.

And while that number above feels like a lot, we feel lucky that we were able to book enough nights in 2019 to still make a profit after it was all said & done (high five, anyone?!). Are we going to be out of the red for all of our construction and furnishing costs anytime soon? Nope! But at least we’re on our way, and we got to learn a lot and have a bunch of fun in the process.