One of the first steps we took when we officially dubbed ourselves “house hunters” was to find out how much house we could afford. Sure, we knew what was in our bank account and what sort of mortgage payment we could handle… but it’s not about what we think. It’s about what the banks think. So we made an appointment with our lending agent (the same guy who helped us buy & later refinance this house) so he could analyze our assets to estimate what loan amount we’ll get – which obviously will help us determine the price range of the new house that we should be hunting for.

We were cautiously optimistic about this appointment. Optimistic because in the years since our first purchase in 2006 we’ve saved more and now that we’re married we knew we could combine our assets (we were engaged in ’06 when we purchased this house, and Sherry was only four months into being self-employed as a freelance copywriter so her income was considered “unstable” and I had to qualify for the house loan all by myself). But although we assumed we had to be in a better position today than we were four and a half years ago with only one income to consider, we still weren’t doing cartwheels because we know that banks are much more conservative these days. Plus now I’m the one who has only been self-employed for a few months. So Sherry can call me unstable this time.

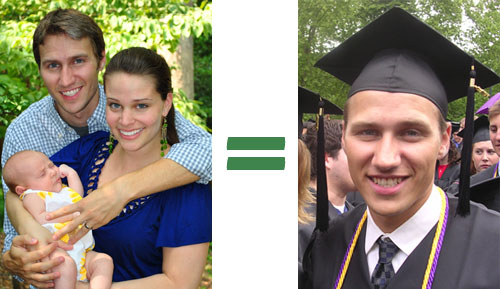

In preparation of our big loan meeting, we gathered old tax forms & W-2s and calculated bank account balances. Then we sat down with our lending guy. His news wasn’t great. Since I’m no longer employed by the company that contributed 75-ish percent of our income in 2009 the banks weren’t going to count that income since I was no longer with the company. Not one dime of it. Instead, they’d base their approval solely on income from our current jobs (i.e. this blog) from the 2009 tax year. Without naming numbers, let’s just say that made us look less like two people who’d been working full-time for 6 years, and more like one person who just landed their first job after graduation. Crap.

Our lending agent said that in order to get this year’s blog income considered (which isn’t a ton, but is definitely more than our ’09 earnings) we’d have to wait until our 2010 taxes officially hit the books next spring.

Cue the womp-womp sound effect.

But just as we were about to mentally put our house hunt on hold, we got some good news. Despite the income issue, our good credit and our on-time mortgage payment history with our current house could still get us approved for a loan equivalent to the value of our current house. Good, except that buying a house of the same value doesn’t necessarily get us that smidge of extra square footage that we think will come in handy in the coming years as our family grows.

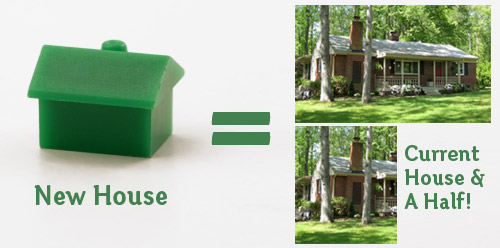

Then a light bulb went off (okay, more like our agent flipped the switch). We had forgotten about all of the equity in this house that we get to leverage by selling it. In other words, since we’ve paid off half of this house (it was extremely affordable and we put a lot of money down) that means our next house can be this house-and-a-half thanks to rolling that equity (read: money) over into the new house after selling this one. Not that we’re looking to go that big or spend that much. At all. But it’s comforting to know that we won’t be stretching financially (well, we already know how much we can afford, it’s just nice to know that the bank might just agree).

So let’s just say that taking a pay cut to be your own boss along with your self employed wife isn’t the best strategy to get the bank on board with you. Lesson learned.

In the end we’re happy with the outcome of the pre-approval process since the number we’re approved for puts us right in the perfect window to find a slightly-larger version of this house (about as big as we had hoped to make our current house back when we talked about adding a small addition on the back to give us some room to grow in the future when there are more Petersiks around). And this pre-house-hunting research gives us some extra leverage with realtors and sellers (they seem to like us pre-approved folks).

Now that we have the money stuff semi figured out, it’s time to pin down what we’re looking for in the next house when it comes to style, layout, and all that good stuff. Knowing Sherry there’s going to be a list involved. The girl is list crazy.

Psst- We announced our big winner for this week’s contest at the end of Monday’s original contest post. Click here to see if it’s you.

Cait @ Hernando House says

Ok wow, the equity part of that went over my head at first. I guess that means it’s a good thing the only bank-realted house thing we may do anytime soon is refinancing?

Looking forward to your list of what you’re looking for in a new house!

Wintry Mix says

Having just gone through the whole mortgage deal in the spring, I can totally relate. At that point I was a newly ordained minister with a signed contract saying a congregation would be paying me XX and I would be starting on XX date, but since I hadn’t started yet (so that I could focus on the house-hunt, ironically) the bank was very, very nervous. Plus my music teacher husband’s income was also deemed “unstable” even though he’d been working at the same school for 10 years. In our case, it all worked out fine because the mortgage payment that WE thought we could afford was way less than the bank thought we’d want, so they were comfortable lending us the smaller $$ required for our sane and manageable mortgage.

Question: are you figuring a higher resale for your current house into the equation, or will any profit just be icing on the cake? I know that the market is terrible right now, but even so, with all the improvements you’ve made I would think you’d make a ton of money! A whole nother bedroom, for Pete’s sake! And the landscaping, and on and on and on.

YoungHouseLove says

Hey Wintry Mix,

We’re figuring in a higher resale value for our house since it appraised for a good amount more than we bought it for. But with all the money that we put into it we only think we’ll make a smidge more back (since we bought in the bubble and are selling in bad-ish times). We’ll just be happy to make a little money though, and the fact that our next house will be such a great deal since we’re also buying in these times (with awesome interest rates as well) really makes it a no brainer.

xo,

s

Melissa says

One have-to-have I discovered on our recent house hunt is a mud room. So nice with kids and all their stuff, book bags, shoes, hats, etc.

KT Murphy says

Wow, thank you for sharing all of this! I know I’ll be looking up this post again in a few years when we start looking to buy.

Also, CONGRATS on the new Nest issue that’s out! I spotted your house all over it! You guys are such an inspiration for young families in this tough economic time!

Tim says

How concerned are you with the fact that you bought at a really bad time? Most people who bought a few years ago and are trying to sell now are usually taking losses, especially in that area.

YoungHouseLove says

Hey Tim,

Scroll up a few comments for that info!

xo,

s

Jessica @ How Sweet says

This stuff normally makes my head spin, but you put it in a way I can understand!

One Junk Drawer says

Hi- Love the cute as pie site and just tried to use the YHL code but it did not work???

Hillarie

YoungHouseLove says

Just heard from Danielle and it’s all working now!

-John

trey says

just curious about the purple/gold cords around john’s neck in his graduation photo? what are they for? i had some just like that… wondering if we might be kindred spirits

YoungHouseLove says

Hey Trey,

Those are from his honor fraternity (Phi Sigma Pi).

xo,

s

Sally says

I think this might be my very favorite DIY series yet! It’s a brilliant, totally timely look into the housing market and what it takes to make this sort of move. You both seem to value thorough research (something I value greatly) and I look forward to reading about the process.

I mean, the search for Clara’s crib was pretty epic in its own right. I can’t even imagine what your house search will be like! All the best as you start this venture!

Kate says

Oh man. The same thing happened to us when we were looking for a house last year. The banks will only look at 1099 or W2 income, not both.

We had to go with our 1099 income too, and in the end, our file at the lender’s office was at least 3 inches thick with paperwork to prove what we earned. We even had to pay an accountant to audit us for the lender. I guess they are surprised when people can make a living on their own!

It all worked out, but get a head start on your books now if they are not super organized already.

Jenn L @ peas and crayons says

This blog has been so ridiculously inspiring. Thanks kids! I was thinking about buying my first home within the next year or so and there is so much to consider! Thanks for sharing =)

Christin says

Thanks so much for sharing this process with all us readers. Congrats on the pre-approval!! My hubby and I rent and will continue renting for a while, but really want to buy some day. However, the idea of house hunting and figuring out down payments, mortgages, etc is really overwhelming to me! So thanks for sharing how you’re going about it. It’s great to get another real-life perspective, especially from frugal savings people like yourselves that buy within their means and such. :) Good luck house hunting!

mp says

I’m sort of like you guys — I bought an extremely affordable fixer-upper and have been fixin-uppin’ since 2006. However, I’m in my late 40s and consider this my perfect and final home, so I’m focused on getting my loan paid off. For right now, I’m not putting any extra moolah into house projects (unless they’re an emergency, like the replacement sump pump last week) – everything’s going to paying off the mortgage.

YoungHouseLove says

That’s definitely a smart approach in your forever home for sure. It’ll feel so good to have a totally paid off home! Paying interest burns us, so your plan is awesome.

xo,

s

Rebecca says

I think the list must have a large soaking tub… for Sherry’s sake :)

Debbie B. says

Love the way you write! It all makes sense and you both are so creative! Thanks :)

Letty says

My fiance and I are starting the house-hunting process and I am terrified about the whole loan thing. Thanks for this post and I hope you continue posting about your house hunt– you’re like my secret weapon!

Lizziebeth says

I have to say, I am really really excited that you guys are putting this whole house hunting experince out there for us all.

I confess, I was incredibly shocked when John announced he was leaving his full time job for the blog. I was even more shocked when you decided that this was the time to start looking for a house. I am in the process of applying for my first mortgage and our financial consultant expressed to us how important it was taht we had been with our jobs for 3+ years.

I hope everything works out for you guys!

LB

Allison says

Viva list-crazy girls!

Fear us. You gotta be organized to take over the world.

Amy says

My husband and I were in the same boat for our first house that we bought this June. We started a business in 07. Even though it grew and grew every year, and even though I’ve held a steady full-time job all the while, the local banks still see it as a big risk. With our good credit and down payment, we did secure a mortgage, but with a higher interest rate than two people employed outside the home. The good news is that it forced us to be more conservative, which will allow us to save.

Which brings me to my question. Because we bought a small ranch, the Realtor said we would never really be able to make much more on it than we bought it for. It has a great foundation- well built, well cared for, and with land. We’ve put in sweat equity, installed a beautiful wood stove (wood is by far the cheapest heating option in this part of MA), and are transforming the ugly 1970’s ranch bit by bit.

Do you really think that updating the decor and floor plan of the home won’t allow us to make even a smidgen of money on this place? I hate to think all this work is for nothing more than my own peace of mind. I’m glad we found a place that meets our needs (for the foreseeable future) in case her comments are really true!

YoungHouseLove says

Hey Amy,

We can’t speak for your area specifically, but real estate tends to appreciate over time (not lately, of course) but if you hold onto it for a few more years you’ll likely see the value grow naturally. We’re figuring in a higher resale value for our house since it appraised for a good amount more than we bought it for- but with all the money that we put into it we only think we’ll make a smidge more back (since we bought in the bubble and are selling in bad-ish times). We’ll just be happy to make a little money though, and the fact that our next house will be such a great deal since we’re also buying in these times (with awesome interest rates as well) really makes it a no brainer. So our advice would be to hold onto your house if there’s no rush to make the most money on it (but know that other homes that you might buy at that time of selling will also be more expensive since their value will grow along with yours). Hope it helps!

xo,

s

Amanda says

Good Luck. We hope to buy a fixer-upper farm in the near future, but I have to say the idea of a 30 year debt (or even 15 if I have my way) is very scary. Actually, the whole mortgage process in general is scary when you are coming out of a rental situation!

Kate @ Twenty-Six To Life says

Honestly, I think the real lesson learned here is that you guys are ridiculously good with your money and it’s paying off (literally!) for you. I wondered how being bloggers would affect your ability to get a loan, but it looks like you’re making it work because you’ve both been so thoughtful about how you save and spend your money. Big kudos to you.

Carole says

up until recently, I’ve been self-employed, so I have dealt with that experience at the bank, too…when we went to our bank in advance of buying our new place last year, we already had a price range in our head, and just gave the bank our (modest) upper limit, and luckily we qualified for that without having to include my income.

We probably could have qualified for more, but we’d rather set our own budget than have the bank tell us what we can afford–I think that’s good advice for first-time home buyers!

kate says

Another possibility you may not have considered… your current basement is small & not heated, right?

Usually basements are not counted in square footage (and price!), but some can have heat & lots of light. I could totally see you guys getting a similar sized house but with a full basement & creating and office and play room down there.

If not, will you come over and fix up my empty basement? I need some ideas, people! ;)

Morgan says

We had the same problem trying to get a new mortgage this year. We’re selling our current home, and attempting to buy a bigger one, but my husband has only been self employed for 1.5 years. The bank won’t consider his income as part of the loan process until February of 2011. Luckily, we were able to find a company to pre-approve us, but the number isn’t as large as what we’d hoped for.

Dawn Mc says

Pre-approval is interesting. Our mortgage broker asked my husband and I what we wanted him to say we could afford. To say the least we think we can afford much less than he says we can afford.

Now we just need to find the house we want especially since our current home went under contract yesterday and inspection is today. Wow!! I didn’t realize it moved so fast. I guess that is part of the learning process for first time sellers.

Good luck and I am glad that the light bulb went on:)

tarynkay says

Glad to hear that it will work out for you! We bought our house last year, after I had been working just a few months and my husband’s job had just doled out 20% paycuts to all employees (rather than doing massive layoffs.) So we were really nervous about the bank approving us. But like Wintry Mix, it turned out that the bank thought we could afford far more than what we thought we could afford. We were committed to being able to afford our mortgage and all living expenses on just one income, and the bank thought that it would be just fine if we spent 50% of our *joint* income on the mortgage! So we ended up getting a mortgage for less than half of what the bank approved us for, which worked out just fine.

abriana says

I’ve been wondering about this topic! Thanks for sharing some lessons learned. I own a small business that is less than a year old and have always wondered what affect that would have on loans in the (hopefully near) future!

Tiffany S. says

Thanks for being so honest about money stuff. If we didn’t have a financial advisor, we would still be in the dark about so much money stuff. If folks had been better informed, we could have avoided a lot of the financial crisis that has taken place.

We put a lot of money down on our house but then we put a lot into it. Many of the improvements we may not recoup but sometimes you can’t look at things that way. Not all real estate investments are a sure thing (and, hey, we wanted a hot tub on a nice patio).

Good luck!

Mary says

Y’all are, I gather, regularly sending in extra on your mortgage payment? That’s a great idea for everyone, get that thing paid down asap to save interest down the line. We’ve had our house paid off for 20 years (we’re nearly 60) and we did it by living frugally and sending in those extra payments. Just wanna share that with everyone during this mortgage discussion – it is wonderful knowing you totally own your home.

YoungHouseLove says

Hey Mary,

Yes, we put a lot of money down when we purchased our house and we do overpay when we can. We hate the idea of all the interest over the course of 30 years that a bank can collect, so we have always been interested in paying things off faster. We got a 15 year mortgage on this house and are still unsure if we can do that with the next one given the bank’s evaluation of our business but we’ll certainly try!

xo,

s

Jasmeen says

Thanks for sharing this. I am in the process of starting my business and also selling my house. I’ll have to be extra-careful for buying the next house.

Kim says

Thank you so much for including us readers in this process. I am hoping to buy my first house in a year or two, so this is invaluable knowledge to me. I was feeling a little disconnected from yall with all the baby stuff since that is just not up my alley for several years, so I am very thankful for this development to which I can wholeheartedly relate. I want you to divulge as much information as you possibly can during this process!

Kate says

Nice you guys have some equity, since I would not want to try to get a bank loan these days with only SE income. GL!

Emily S says

I was glad to see your post on this because quite frankly, I was kind of wondering how you were planning on getting a new house. We just sold a house this summer, and it was our worst real estate transaction ever. This is a terrible time to buy and sell houses. Dealing with lenders is a nightmare right now and actually getting a deal closed… bleh. Not to be Debbie Downer or anything but I will say, selling this last house resulted in my first grey hairs (boo). The whole thing really opened my eyes to a lot of the problems going on right now that you don’t even hear about in the news!

On that note though, I wish you both MUCH luck! I have my own selfish reasons… I cannot wait to see you guys do another house!!

Jenn says

I always love your wise approach to all things financial. My husband and I purchased our home a year ago just as I was becoming a stay at home mom. We held off on house hunting to be sure we have a good downpayment but we also made sure that what the bank said we could afford actually worked for us. We lived with a mock budget for a good 6 months just to be sure that we could manage, especially without my income. We ended up being more conservative that the bank was but it works for us and we could go into a new home with confidence.

Melissa @ Houseography.net says

I think we are refinance-aholics. Do they have a 12 step program for this? I don’t think we’re alone in this with the crazy falling interest rates over the past few years. We have definitely covered our closing costs so overall it has been worth it. At least you have interested rates on your side. We talked to several lenders and found we got better service and higher approval amounts from local banks and lenders, than from the national banks. Most large banks woud not touch our construction loan in late 2008 (remember how bad the economy was then), but several local banks were willing to take on the risk because they knew how robust the DC “inside the beltway” housing market was, instead of looking at the state as a whole which was not as good. My advice – shop around and talk to a lot of people. You may get a surprisingly different story (good or bad) when you talk to others.

mike says

Oh man, I do not miss the mortgage process game.

Ashley says

Two things my next house must have:

1. more cabinet space

2. a big ol’ tub

We’re going through the refinancing process right now, so this was a very timely post!

Sarah @ The Ugly Duckling House says

I used to be in the mortgage biz, so when it came time to buy my house at the end of December 2009, I felt like I had things under control… but as a first time homebuyer, it was still incredibly stressful!

Two tips to always remember:

1: Banks like at least 3 open lines of credit with at least 2 years of payment history. Keep your credit cards active, even if it means buying only a candy bar every few months and paying it back. Pay on time. Always. I know that’s a given for good credit, but I guess it’s just something that gets etched into your brain looking at credit scores every day year after year.

2: Two to three years of income history is a must (unless you just got out of school). This means a steady income that you can show either through pay stubs or on your tax returns, and if you change industries (say from finance to engineering) or go from a steady job to self-employment (like John did), you can kiss your previous earning history argument goodbye. Even when the mortgage industry was a lot more lenient, this was still what I had to tell borrowers.

I could go on and on (and sorry that I already have), but the loan process can be intimidating, so I hope this helps someone! Good luck!

Holly West says

Your financial/saving/money posts are great. I wish you guys had been around when I was your age (read: lots of bad financial decisions in my 20s).

Amy says

That is great that you two got set up on the 15 year mortgage. Regardless of the bank approving you for it the more loose structure of a 30 year couldn’t hurt.

Congrats on the pre-approval and hopefully the equity really helps things out too! With the conservative nature of the pre-approval do you think you will want to go up to the amount that they approve for you?

YoungHouseLove says

Hey Amy,

No way, we’re cheap!

xo,

s

candace @ thecandace.com says

I appreciate your candid post. We currently have our house on the market – but will most likely take it down for the winter and try again next spring (with hopefully a lot better luck)! My Hubs is self employed and I didn’t think about the impact that might have on our next house (if he is considered unstable income) so I am glad you brought it to my attention! Good luck house hunting and thanks for taking us along on the ride!

Design Girl (Cori Busch) says

House buying seems so scary…Especially because we’ll want to purchase in Southern California (L.A.), you get nothing for $500K!

I think lists are part of the female make-up….Whenever I start a sentence with ‘So I made an excel sheet…’ my fiance says ‘Of course you did’.

:)

Lauren says

Thanks for bringing us with you through this process! We’re no where close to looking for our second home, but I’m sure I will learn a lot as you blog about your experience.

I also wanted to say that I like the “You May Also Like This” section at the bottom of the post. I’m not sure how long that’s been there, but I’m sure it will cause me to spend even more time reading your blog :-)

Shelley says

My husband and I are both self employed as well and per our lender had to wait till we were self employed for 24 months before making a purchase. We also knew this from our days spent in the mortage biz. But there are other options to prove income other than tax returns…like bank statements. We used a bank that caters to farmers and merchants and they had a fantastic program for us and understood our “special” circumstances of being self employed. 30 days we closed. Currently owner occupied but will soon turn into rental #2 as we hunt for our “home”. Ahhhh, home…the last 2 have been a process of acumulating property and we are thrilled at the thought of being “home”. Oh the DIY dreams I have ;)

Sarah says

It seems like if you could only afford the selling price of your current house you’d still be in great shape. After all, aren’t you looking for a project? It seems to me that you’d definitely be able to find a larger home (that needed lots of work) for the same price as your smaller, but nearly perfect home. Good luck!

YoungHouseLove says

Hey Sarah,

This is true, although we are looking at some slightly nicer neighborhoods with amazing schools since were keeping the buy-the-worst-house-in-the-nicest-neighborhood advice in mind! So even though the house will need work and not be too big it still might cost more than our current house.

xo,

s

Miranda says

I work in finance and my husband and I just bought our first home about a year ago. We plan to have it paid off by the end of next year, since we bought well below what we were approved for.

If you don’t qualify for a 15 year mortgage (and the slightly lower rate that goes along with it), you can still plan to pay your mortgage off in 15 years. If you have Microsoft Excel, type in “Loan Amortization” in the help box. Download the Loan Amortization spreadsheet and enter in your mortgage terms at the top, but use 15 years instead of 30. This will tell you what your monthly payment should be if you’d like to pay it off early. It normally isn’t that much more than a 30 year due to interest savings. Just make sure your lender doesn’t charge you a pre-payment penalty.

Hope this helps someone!

Julie says

If you can sell on your own that would be such a big help. I was shocked when we paid almost $20K in fees when we sold our house a few months ago!!!

Secondly, for those who talk about paying off their house early, I’ve always been told NOT to do that. With interest rates as low as they are now, it’s almost always better to invest that extra $. You’re sure to get back better than the 4.8% rates are at now (over the long haul). Any thoughts?

YoungHouseLove says

We’ve heard that too- I think it’s just all about how people personally feel about debt hanging over you. We had six months of interest free time to pay off our kitchen but we just hated having it in the back of our minds so we paid it off much faster, just to sleep better at night!

xo,

s

Sara says

For all the first time homebuyers out there – when I contemplating buying my first house I was scared to death, even thinking about the enormity of it was overwhelming! But I will say that the process was far simpler than I thought it’d be (while my husband and I do freelance work, we have full time “out of house” employment as well).

Like you guys (Sherry and John) we are cheap, and refused to spend anywhere NEAR what they pre-approved us for. Some banks seem to be willing to approve for so much more than is wise, isn’t that how we got into this mess in the first place?

I’m so impressed that you put down a big down payment and have been paying it off on a 15 year mortgage. I try not to think about all the interest I’m paying, but it burns me up too!

Stephanie says

I’ve been reading for a while now and maybe you have already done this, but I’m not remembering or maybe it is something you could do it the future: a breakdown by % of your monthly budget. My husband keeps wondering why we always feel broke and I say it is b/c we spend too much of a % of our income on transportation costs. Two car payments, fuel, maintenance, etc. Thanks!

YoungHouseLove says

Hey Stephanie,

We haven’t done a post like that specifically, but we do share a ton of ways to spend less on extras like eating out and haircuts on our Projects Page (scroll down to the Money category near the bottom). We’re also a one car household which saves us loot on insurance, gas, maintenance, etc (although we know not everyone can do that, carpooling and things do make it possible for some people). Hope it helps!

xo,

s

Yulia says

Love this post! We’re considering re-financing now that rates are so low and are tying to decide the term of the refinance. You mentioned that you hope to get another 15 year loan, rather than a 30. I hope this question isn’t too personal, but I am wondering why you wouldn’t rather get a 30, but pay like it’s a 15? Currently, I’m thinking that the lower monthly payment of the 30 would be like a little bit of insurance in case we ran into hard times.

YoungHouseLove says

Hey Yulia,

The rates are slightly lower on a 15 year mortgage, so we like that we could get the best possible deal. You’re right about the security of a 30 year loan though, so it’s really all about personal preference. And we definitely wouldn’t be sad to end up with one.

xo,

s