One of the first steps we took when we officially dubbed ourselves “house hunters” was to find out how much house we could afford. Sure, we knew what was in our bank account and what sort of mortgage payment we could handle… but it’s not about what we think. It’s about what the banks think. So we made an appointment with our lending agent (the same guy who helped us buy & later refinance this house) so he could analyze our assets to estimate what loan amount we’ll get – which obviously will help us determine the price range of the new house that we should be hunting for.

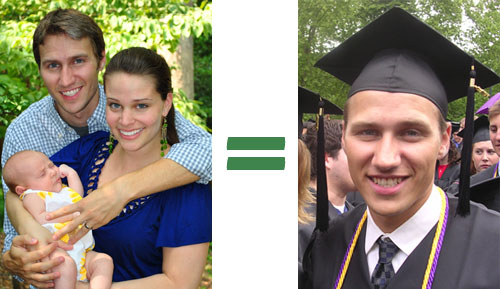

We were cautiously optimistic about this appointment. Optimistic because in the years since our first purchase in 2006 we’ve saved more and now that we’re married we knew we could combine our assets (we were engaged in ’06 when we purchased this house, and Sherry was only four months into being self-employed as a freelance copywriter so her income was considered “unstable” and I had to qualify for the house loan all by myself). But although we assumed we had to be in a better position today than we were four and a half years ago with only one income to consider, we still weren’t doing cartwheels because we know that banks are much more conservative these days. Plus now I’m the one who has only been self-employed for a few months. So Sherry can call me unstable this time.

In preparation of our big loan meeting, we gathered old tax forms & W-2s and calculated bank account balances. Then we sat down with our lending guy. His news wasn’t great. Since I’m no longer employed by the company that contributed 75-ish percent of our income in 2009 the banks weren’t going to count that income since I was no longer with the company. Not one dime of it. Instead, they’d base their approval solely on income from our current jobs (i.e. this blog) from the 2009 tax year. Without naming numbers, let’s just say that made us look less like two people who’d been working full-time for 6 years, and more like one person who just landed their first job after graduation. Crap.

Our lending agent said that in order to get this year’s blog income considered (which isn’t a ton, but is definitely more than our ’09 earnings) we’d have to wait until our 2010 taxes officially hit the books next spring.

Cue the womp-womp sound effect.

But just as we were about to mentally put our house hunt on hold, we got some good news. Despite the income issue, our good credit and our on-time mortgage payment history with our current house could still get us approved for a loan equivalent to the value of our current house. Good, except that buying a house of the same value doesn’t necessarily get us that smidge of extra square footage that we think will come in handy in the coming years as our family grows.

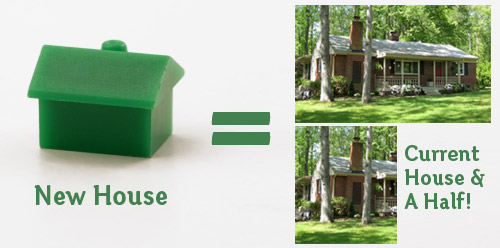

Then a light bulb went off (okay, more like our agent flipped the switch). We had forgotten about all of the equity in this house that we get to leverage by selling it. In other words, since we’ve paid off half of this house (it was extremely affordable and we put a lot of money down) that means our next house can be this house-and-a-half thanks to rolling that equity (read: money) over into the new house after selling this one. Not that we’re looking to go that big or spend that much. At all. But it’s comforting to know that we won’t be stretching financially (well, we already know how much we can afford, it’s just nice to know that the bank might just agree).

So let’s just say that taking a pay cut to be your own boss along with your self employed wife isn’t the best strategy to get the bank on board with you. Lesson learned.

In the end we’re happy with the outcome of the pre-approval process since the number we’re approved for puts us right in the perfect window to find a slightly-larger version of this house (about as big as we had hoped to make our current house back when we talked about adding a small addition on the back to give us some room to grow in the future when there are more Petersiks around). And this pre-house-hunting research gives us some extra leverage with realtors and sellers (they seem to like us pre-approved folks).

Now that we have the money stuff semi figured out, it’s time to pin down what we’re looking for in the next house when it comes to style, layout, and all that good stuff. Knowing Sherry there’s going to be a list involved. The girl is list crazy.

Psst- We announced our big winner for this week’s contest at the end of Monday’s original contest post. Click here to see if it’s you.

Kylee says

Great discussion on mortgages! I too hate the thought of all the interest. I think lots of people don’t even consider a 15 year mortgage but you should always have the lender present the numbers for 15 and 30 years. The difference in the monthly payment is a lot less than what you would think just because of all the interest you save. If you’re not sure if you can swing the 15 year payment go ahead and set it up over 30 years but then make the 15 year monthly payment. That way you’re getting it paid down but if money gets tight you’re not committed and can make the regular payment! Oh and if your lender will allow it making a weekly or bi-weekly payment instead of monthly saves tons of money in the long run!

FMT says

If you do go with a 30 year mortgage, you can just pay the equivalent 15 year mortgage payment every month. This gives you the flexibly of paying the 30 year payment if money gets tight. This has been my strategy to pay down the mortgage. I refinanced about a year ago since interest rates were so low.

YoungHouseLove says

Hey FMT,

The rates are slightly lower on a 15 year mortgage, so we like that we could get the best possible deal. You’re right about the security of a 30 year loan though, so it’s really all about personal preference. And we definitely wouldn’t be sad to end up with one.

xo,

s

Charity says

Long time reader. First time commenter. Haha. I’m just curious how much you guys will budget for re-doing the rooms in your new house? Is it something you will include in your loan or will it just go room by room in your future monthly budgets?

YoungHouseLove says

We won’t include that on our loan because we like to save up and use money from our actual savings account for those things. That way we’re only borrowing the amount that we need for the house and we can put a good amount of our savings down at closing while keeping some cash (and saving some more) for fixing things up as we go!

xo,

s

Sarah says

I appreciate how sensible you are about money!

Like others commenting, when I applied for a mortgage in 2006 I was offered a loan for WAAAAY more than I thought I could afford. I was really glad I had crunched the numbers on my budget in advance. I had two years of my spending info in Quicken to help guide me.

I bought while single, so I chose a 30 year to give me flexibility in case of a job loss or other big financial hit, but I wish I could have gone with a 15 year. Maybe next time!

kristen f davis | kfd designs says

i feel your pain, kids. banks don’t like self-employed people..my husband and i had to do the same thing when we bought our condo last year (i wasn’t even considered for the loan, since i’m self-employed, even though i pay half of EVERYTHING). kind of makes you feel like you’re unemployed or something! i guess it just takes time to prove that you make money, and are consistent!

KC says

Hey Guys,

IT is a tough market out there so lenders are getting strict with guidelines. Good luck with the process You will get there it will just take longer than expected.

KC

Lindsey d. says

I bought my home a little over a year ago. Nearly a year before that, I met with my mortgage broker for the first time. I laid out everything for him, told him this is what I want to spend per month and I want to borrow no more than this total. Both were numbers I felt very comfortable with. I told him I DID want to know if I wouldn’t be approved for that amount, but that if I would be approved for more, I DID NOT want to know about it. It was an easy way to stick to my numbers and not the banks.

In the end, I bought for less than what I budgeted and now I’m paying that extra (about $100) on the principal every month to meet what I originally budgeted as my house/insurance/taxes payment. It’s not a lot, but it will turn my 30 year mortgage into about a 25 year mortgage, and I hope that I’ll be able to increase that additional principal payment over the years.

Rabbit says

I have to agree with Stephanie’s comment (quoted below). It all depends on how much info you want to give out, but I know I’d find it helpful to see how much you spend on various things. Percentages only, since giving out actual figures could start some trouble. I know, it’s a very personal request…and I’m sure we’d all understand if you’d rather not. I think that a lot of people are honestly curious how one can afford life by blogging–and not just you guys!

This comes from someone who makes a fairly good combined income, but there’s not a lot leftover after 30% of my salary disappears b/c of health insurance. My health insurance costs more than my property tax!!!

[Stephanie wrote:

I’ve been reading for a while now and maybe you have already done this, but I’m not remembering or maybe it is something you could do it the future: a breakdown by % of your monthly budget. My husband keeps wondering why we always feel broke and I say it is b/c we spend too much of a % of our income on transportation costs. Two car payments, fuel, maintenance, etc. Thanks!]

YoungHouseLove says

Thanks for the suggestion! We’ll give it some thought and see how much we feel comfortable divulging. We definitely spend a ton of money on health insurance and other business related expenses (see more about that info in this post). Hope it helps!

xo,

s

Nikki says

I am sorry if you have already addressed this question…but have you started looking at porperties yet? Or are you waiting till you get an interested buyer before you go on “the hunt”?

YoungHouseLove says

Hey Nikki,

We’re driving around and looking at exteriors (and checking out things on MLS, etc) but we promise to detail our house hunting adventures when they pick up!

xo,

s

Christina says

That’s great news!! And I applaud you for going with a 15-year fixed mortgage rather than a 30-year. We would have done the same thing, but felt a little safer with the 30-year. And, I just heard on the news today that mortgage rates have falled again to all time low of 4.32 for 30-year, and 3.72 for 15-year. So, congrats!!

We just closed on our house and went with a 30-year at 4.375. Still not a bad deal, at all!

And, keep in mind that house prices have also fallen, nearly everywhere. So, you’ll be surprised at how much house you can actually afford nowadays. And, with the economy the way it is, a lot of people are willing to negotiate. So good luck!

Mary @ stylefyles says

Thanks for this post. I’ve never owned a house, but hope to in the next few years. I’ve read up on the matter, but it’s nice to learn via a pictured tutorial and a summary written by a normal person (not that you two aren’t special) rather than a finance guru or bank lender.

Kate says

I love money posts :) I’ve heard too that it’s not necessarily the best thing to pay off your mortgage. Besides being able to invest that money elsewhere, doesn’t it also help when it comes to taxes? I can’t remember how, but maybe it gives you a tax break? If anyone is familiar with this and can explain it, please do so.

YoungHouseLove says

Anyone have that info for Kate?

xo,

s

Jess H. says

Hey you guys…

I’ve pasted a few websites below that really helped me in my house-hunting process.

(FYI, I am NOT affiliated with ANY of these companies/organizations, nor am connected to the industry at all…)

A site that can be good to find out the market value of a bunch of homes in a particular neighborhood – http://www.zillow.com.

You might want to play with it a little bit as it has A TON of features.

It might not be much different from zillow, but I thought you might also want to test Chase’s site out for looking up home values in specific locations:

https://www.chase.com/ccp/index.jsp?advertid=&srcid=&pg_name=ccpmapp/home_equity/tools/page/home_value_estimator

Also, http://www.realtor.com is a fab site for just browsing what is out there… the only prob – most (if not all) of these homes are represented by real estate agents (which means additional fees.)

Some good FSBO sites:

http://www.homesbyowner.com/

http://www.forsalebyowner.com

http://www.owners.com/

http://www.homes-for-sale-by-owner.info/

Lastly, not sure how VA operates, but most of the counties here have all of their tax info for EACH INDIVIDUAL PROPERTY available online. It might be worth checking into what your county offers in terms of tax information.

Since this “ain’t your first time at the rodeo” you may be familiar with most (if not all) of these sites… If so, perhaps your house-hunting readers might find this post useful???

Keep up the good work, kids! Love your site!

Erin says

I live in Richmond and have a few ideas for your next house. While there are many amazing neighborhoods in Richmond, if you’re looking for good public schools, that narrows the list. My thought: stay in Bon Air! Close to the city, but with great county schools. To be more specific, there is a fabulous (at least from the outside) home in my neighborhood that needs lots of TLC. The big catch: it’s not technically for sale. It is, however, vacant, as the previous owners had to go to a nursing home. Word on the street is that the children who now own the home don’t know what to do with it. I think you could convince them to sell it. If you want more specifics, send me an email. (Also, I have nothing to gain from this except that we’d love to see people who care about their home move into our very fun neighborhood.

YoungHouseLove says

Thanks for the tip Erin! When we’re into the full on house hunting stage we might just drop you a line!

xo,

s

Jenny@Evolution of Style says

We put our house on the market in late April in the hopes of taking advantage of the historically low home prices and mortgage rates. We didn’t *have* to move, and if our house didn’t sell, we would just stay put for awhile longer. Lo and behold, just as we were about ready to throw in the towel, an offer rolled in. We close in less than two weeks, and although we sold for less than our purchase price in 2004 (despite $$ invested in upgrades), we are really hoping to get a house on Blue Light Special on the flipside. In the meantime, since banks take FOREVER to process short sales (which is what we offered on), we’re (family of five) moving in with my parents. Not ideal, but it’s a lot more fun looking for houses when you’re a buyer with cash in hand and no contingencies!!

Best of luck to you! Buckle your seatbelt and get ready for the real estate roller coaster ride. :-)

kristin says

Hey Kate,

I know that you can deduct the interest paid on your mortgage from your taxes, but since it’s a deduction (reduces the amount of your taxable income) and not a credit (reduces your actual tax), I don’t really thing it’s worth it. To put it (probably too) simply, why send the bank $5,000 to avoid sending the IRS $500?

kristin says

Oops… *think* it’s worth it :)

Stacy says

Kate,

This article discusses reasons one might not want to pay down their mortgage:

http://articles.moneycentral.msn.com/Banking/HomeFinancing/DontRushToPayOffThatMortgage.aspx

Randa says

For Kate:

The interest that homeowners pay on their mortgage per year can be counted as a tax deduction, and that can be a big help on a year by year basis. However, some people prefer to pay the mortgage off early and not pay so much interest in the long run.

Hope it helps,

Randa

YoungHouseLove says

Thanks for sharing your expertise with Kate, everyone!

xo,

s

Kerry @ just-you-wait says

Thanks for taking us along on this ride with you! Your post (and the discussion here in the comments) has been really interesting.

You mention that you had your house appraised… I’m not sure if you mean at the time of purchase or recently, but I was just wondering if you’d be willing to share how much value (dollar figure or percentage) you’ve added to your home through all the work you’ve done? I’m in the process of updating my own place, and am very interested to see how much added value all this hard work will bring!

YoungHouseLove says

Hey Kerry,

We had an appraisal in 2009 when we refinanced and the appraisal came in at around 35K higher than the original purchase price (even though we bought in the bubble and appraised it in during the recession). Since then we’ve also renovated the full bathroom, added value to the basement with that makeover, and added a new roof among a few other things. So we hope that it’s worth even more now! The ultimate test is selling it, because no matter what an expert says it’s worth, it’s really worth what you get for it! Fingers crossed…

xo,

s

Rebecca says

To answer Kate,

When you have a mortgage, you get to write off the interest on your taxes but that’s like paying $1 and getting 33 cents back. However, the problem with paying off your mortgage is that all your cash is tied up in an asset that is not liquid.

It all really depends on your personal comfort level but if you do the calculation out, it usually is better to keep your cash and invest it in the market. That calculation is subject to the interest rate being used which further complicated things!

Read Suze Orman’s “9 Steps to Financial Freedom” for a good start to answer all questions regarding your personal finances.

Megan says

Hi YHL! I started reading your blog a month or two ago and its been great! My husband and I had our offer accepted for our first place last night and we are getting into the nitty-gritty of mortgages right now. We are hoping everything works out and we close on 12/1. This post + comments are really helpful, I’ll definitely send along to my husband.

Jenny@Evolution of Style says

For Kate – yes, you can write off the mortgage interest on your taxes, but I wouldn’t let this deter anyone from having the goal of being mortgage-free. Look at it this way, what are the net tax benefits of having a mortgage? Yes, you get to write off the interest, but you’re essentially spending money (in interest cost) to “save” money (on taxes).

I would much rather have a bulk of my income to save/invest and pay the extra taxes, than pay a mortgage payment and interest to get the tax deduction.

Hope that helps!

kitliz @ DIYdiva says

I was just thinking along the same lines as Kerry regarding the appraisal, I sold my first house with nothing but a website and a sign in the front yard. The buyers and I agreed on a fair price for the house, signed the papers, but then the appraisal came in $20k less than the agreed price.

(That’s $10k less than what I bought for, and after I’d put approximately $30k worth of upgrades into it including a new kitchen, two new baths, and a patio.)

To say the bubble got me would be an understatement, but I was more shocked to realize that the bank and your neighbors who sell their houses low have more control over the price of the house than the people who actually want to buy it. We worked out a bit of a side deal so I could sell it for what I bought it for and like you, I’d paid half of it down so that definitely helped on the new property. But it was still pretty harrowing.

Sounds like you guys are set up good if your appraisal last year came in at a good range, or if you find buyers who can put a lot of cash down.

For a minute there I was wondering what prompted you to want to sell vs go for the addition, but as someone in the middle of adding 900 sq ft to a house I realize that’s something only crazy people do. Good luck on the sale and the new place!

Kristi says

Soo…that is awesome how you spelled all that out…and congrats =o) What I am curious about is the word REFINANCE. When do you do it? How do you know if you should? etc…

YoungHouseLove says

We met with our loan guy and he went over all that with us- it basically means you get a much better interest rate but you have to pay attorney fees again (like you did at closing) to get it, so sometimes it’s worth it and sometimes it’s not. Good luck!

xo,

s

susan says

See you did need all that math in school that we studied and never thought we would use………………. We are on house number seven. The last one we could pay for in cash because of the equity building and building and building.

Kate says

THANKS YHL readers for answering my question. You guys are the best!

Sherri says

I like to use the Dave Ramsey example with respect to whether or not to pay off your mortgage early:

Dave uses this example: if a person is pays $10,000 interest on his mortgage in a year, he can pay taxes on $10,000 less income that year. If he is in the 30% bracket he will save $3,000. It is not smart to intentionally pay $10,000 in order to save $3,000.

Some will say it’s better to use that “extra” money to pay off a mortgage and invest it. Personally, I’d rather take the extra money, pay off my mortgage early, and then have the FULL mortgage amount to invest later (not to mention it greatly reduces your expenses, enabling you to do things like the Youngsters are…be self-employed). Something we eventually hope to do with our rentals being our main source of income.

barb says

hey youngsters,

i know that we will have to sell our house in about two years from now, due to my husbands job. i have been interested in a few things. first off can you do a post on what it takes to sell a house on your own vs a realtor. and i have heard some people cus of the bad market are getting an inspection done on there dime so people looking at the house know it doesn’t have any hidden problems. is that something your would or are going to do? i am loving this series of posts. keep the info coming pls. at some point all of us will be buying or selling so info is great.

thanks,

barb

barb says

also….are you going to use a realtor to buy a house? how does that work if you do it alone? thanks again for the great posts.

YoungHouseLove says

Hey Barb,

We’re not sure if we’ll use a buyers agent or just go it alone (the difference is that the seller typically pays the buyers agent 3% so many home sellers prefer buyers who go it alone (you can even try to negotiate the price down by 2% or so since the seller doesn’t have to pay that 3% to a buyers agent in that case). We’ll keep you posted to see how it goes and what we end up doing! And we’ll definitely post all about how it goes if we can sell our house by owner or need to go with a realtor after a while.

xo,

s

Ana says

Thanks so much for sharing your experience. I’m beginning the transition to working for myself (while still having a full-time job to stockpile savings) and these issues didn’t even occur to me until I read your post. Now I’m a little freaked out, but hey, it’s better to know sooner rather than later.

Have you considered a 20-year mortgage? I recently was on my bank’s website and it said, “Ask us about 20-year mortgages!” I really wish I had known last year when I bought my house so I could have at least found out details.

YoungHouseLove says

Good point! We’ll have to ask about a 20-year mortgage and see how it goes!

xo,

s

julie says

Sigh… I’m so depressed reading this. My husband and I are in the same boat (sort of) but we’re trying to get our first house. Despite being preapproved, though admittedly by what it now appears to be an amateur mortgage broker, and falling in young house love with a place we put an offer on, its now looking like we’re not going to get approved. For anything. Its not a money thing or about our income level, but like you we have a nontraditional income arrangement and it might be that neither of our incomes count. Now we may have to wait over year to ge t out of our rental. Sorry to vent, sometimes you just need to let it out in the anonymity of the internet.

Tara @ Tara Being Tara says

This happened to us too! When we bought our house, my fiance had been self-employed for less than a year, so we had to qualify for it on my (social worker) income alone. I kept saying to our mortgage guy, “But we can really afford this right? Because it looks on paper like we can’t, but we really can, right?” And we really could, because we had more income than the bank was willing to count, too!

Kate @ Savour Home says

When we bought our house this spring, we had to jump through all sorts of hoops despite the fact that we were both employed reasonably stably because my husband had graduated from law school in 2008, began working at his current job, and took a leave of absence for 6 months to do a job related internship. Still, we ended up with our darling little house and big yard.

Whitney says

So this is not related to your mortgage info, but I know John was part of a Honor Fraternity. Then I see the purple and gold cords in the graduation picture. Where you in Phi Sigma Pi? Just curious!

YoungHouseLove says

Hey Whitney,

Yup, that’s the one!

-John

Mrs. Money says

Thanks for sharing! Of course, now you’ve got me considering a refi. ;)

If you guys are ever up for guest posting on a personal finance blog, let me know! I’d love to have you!

Rebecca Foxworth says

Also, don’t forget that you’re selling your current house “fixed up”, but will most likely buy a “fixer upper”. Yeah, I know the market fell since you last purchased, so your house won’t get the gains you once hoped for. But with your self-gained DIY knowledge, you can also look for a house that is rock-bottom priced because you know lots of fixer-upper tricks that can save you money.

Can’t wait to see what you do with the new place. You know, once you find it and all.

Ashley says

Just want to say that I really appreciate you guys including posts like these. Even though your style & DIY is my main draw, as a first time homeowner it’s really helpful to hear discussion about the nuts & bolts behind the scenes of the whole process. To get the fun stuff & a view into the nitty gritty (with bonus baby & dog, might I add) in one place is rare so thank you!

Roshni says

Great news!!! I was wondering if you could also do a post of what steps you’re taking to sell your house by yourselves

YoungHouseLove says

Hey Roshni,

We’ll definitely share that info!

xo,

s

Ariel says

My husband and I are hunting for our first house, but we live in the Bay Area, so we feel like we’re in a similar situation financially. Wish you luck! Can’t wait to see what you find. You did an amazing job with your first one. :)

Shannon says

Hi guys,

I wondered when you said you were buying a new house about the whole self-employed thing. Here (Ontario, Canada) you have to have proof of 2 years self-employed income before they will even consider that income (or it might as well be zero). Funny, that that matters more than savings and equity sometimes. Best wishes with making it all work – it’ll all be great!!!

Shannon

http://www.akadesign.ca

beth says

You will never regret having “too small” of a mortgage. Wait a year or two and convert it a 15 year….then you are done paying it before Clara heads to college. My two cents!

Maria Bingham says

An addition to Beth’s comment, most lenders allow you to pay ahead on your mortgage without penalty so you could calculate for yourself what monthyly payment would pay off the mortgage loan in 15 years instead of 20 or 30 years. The good part is, if you don’t have the additional money one or more months, you can skip paying it without penalty! It will save you loads of $$ on interest payments if you plan to be in your house for a long time because they charge interest on the ‘remaining’ balance each month.

Although, be careful that the (*#$#*) loan processor company posts the extra dollars correctly. We had a month when the bank did not post it correctly and we spent lots of phone time straightening it out.

-Maria

PS love your blog. I know so much about you guys that you feel like family!

Liliana says

Kate, you might want to read up Dave Ramsey and check out Clark Howard’s web site. Both super savers and both to an extreme but with great advice. I personally like Clark not only is he really nice even to the mean people who call his show but his job is to look out for the general public to not get ripped of and save more.

~ L.

jja says

I am amazed with the fact that you manage to save for house projects, for having a baby and for searching for a new house!

I don’t know anybody at your age managed to pay off half of the house!

Carissa says

I don’t think there is anything that compares with the financial freedom of 100 percent down!!! even if you have to stay longer in the house you’re in it is SOOO worth it.

on that note, have you considered keeping house #1 as an investment? you could rent it out and even though lenders don’t consider rental income in determining your new approval loan you could use it to pay off that mortgage…

or if you go 100 percent down you keep ALL 100 PERCENT of the profit and that totally makes up for renting/living 5 years in a smaller house:)

YoungHouseLove says

Hey Carissa,

We have considered keeping this house as a rental, but we’re not sure if we could bear if a renter stained our beloved granite or otherwise ran down our pride and joy. There’s a nice finality about selling it and saying “it’s someone else’s lovely home now” instead of seeing people potentially take less loving care of it then we would. We also talked to our loan guy and he said that it would be a lot more difficult to work out a rental situation and still get approved for the loan while we could easily work things out if we sold instead of renting.

xo,

s

Handy Man, Crafty Woman says

Up here, a realtor won’t even make an appointment with you to look at a house unless you are pre-approved. We just got pre approved each time before starting to look. That way, we had official “documentation” about how much house we could afford.

Have you guys ever gotten a quote to do an addition to your house? From seeing all the photos and the Layout, I’m not sure how that would work…but did you ever get a quote? As expensive as that would be, it would be less expensive than buying a new house…and there would be plenty of projects to show on the site! Wondering if you could add on a couple of bedrooms, somehow…

YoungHouseLove says

We actually considered an addition for quite a while (it was always our plan to keep this house for the long haul) but after a lot of thought we realized that the existing layout of the house isn’t nearly as flexible as buying something else with more potential and space than any addition we could build onto this home. It was a sad day when that finally sunk in, but we’re so excited about finding that perfect house out there to make our own and have lots more adventures in!

xo,

s

eileen marie says

Comforting to know that as we begin our house hunt this upcoming summer, we can use some of the equity from our condo to upgrade -we kinda forgot about that! We were so worried that due to the downturn in the housing market, we wouldn’t be able to afford an upgrade.

PS: Where can I find your P.O. Box #? I’m a little late, but we picked up a pretty postcard for your wall in Switzerland. :)

YoungHouseLove says

That’s so sweet of you! Our PO Box is listed at the bottom of our “contact us” page, which you can get to by clicking the link on the sidebar with our mugs on it.

xo,

s

Jennifer says

Is there a website that your house is listed under? My husband and I just moved to Richmond and we are house hunting!

YoungHouseLove says

Hey Jennifer,

We’ll email you our little flier with the stats for ya!

xo,

s